Pump and Dumps Are the Final Indignity for Dying Coins

You can tell an altcoin is close to death when its price soars. That may sound like a contradiction in terms, but that’s what can happen to crypto assets when they’re in the throes of death. With low liquidity and thin volume, exchange-listed altcoins are prey to manipulators who will send them skyward one final time for a quick profit. Also read: Bitcoin History Part 7: The First Major Hack

You can tell an altcoin is close to death when its price soars. That may sound like a contradiction in terms, but that’s what can happen to crypto assets when they’re in the throes of death. With low liquidity and thin volume, exchange-listed altcoins are prey to manipulators who will send them skyward one final time for a quick profit. Also read: Bitcoin History Part 7: The First Major HackPump and Dumps Are the Swansong of Dying Altcoins

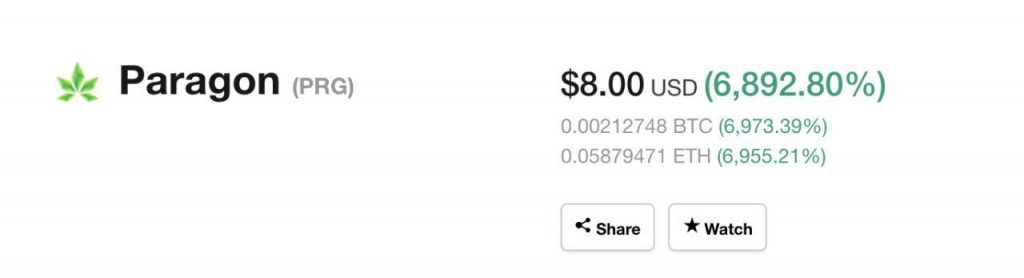

Holders of paragon (PRG) woke up to a pleasant surprise this morning: their coin was up 6,800% overnight. The project has effectively been dead for months, with the SEC ruling in November that Paragon must refund investors who participated in its token sale. News that the worthless token had mooned overnight was thus greeted with astonishment by PRG holders. At 7 a.m. EST on Jan. 1, paragon was trading for over $10, having been changing hands for just $0.30 the day before.

P&Ds and 51 Percents Herald the Beginning of the End

The final indignity of dying coins, it appears, is to be fraudulently manipulated to enrich insiders one more time. As other tokens that launched during 2017’s ICO mania die off like paragon, they risk succumbing to the same fate. As for Proof of Work coins that are also in the process of dying quietly, there’s another means of manipulation – the 51 percent attack. In a blog post published on Jan. 1, prominent bitcoiner Nic Carter performed a post-mortem on 15 cryptocurrencies whose demise he’d predicted at the start of 2018. Of the projects he successfully called out, two had their demise hastened by 51 percent attacks – Verge and Bitcoin Gold. As Carter acknowledged, it is virtually impossible for a cryptocurrency project to die out entirely, as there will always be residual trading volume and someone willing to pay a rock-bottom price in the hope that the asset will return to its former glories, just as paragon fleetingly did today. Even for those coins that are artificially coaxed back into life, however, the movement merely reaffirms that they are on the way out and destined for an entry on Deadcoins.com. Paragon is already there. Do you think exchanges should be more proactive in delisting low-volume altcoins? Let us know in the comments section below. OP-ed disclaimer: This is an op-ed article. The opinions expressed in this article are the author’s own. Bitcoin.com does not endorse nor support views, opinions or conclusions drawn in this post. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the Op-ed article. The opinion editorial is for informational purposes only.

Of the projects he successfully called out, two had their demise hastened by 51 percent attacks – Verge and Bitcoin Gold. As Carter acknowledged, it is virtually impossible for a cryptocurrency project to die out entirely, as there will always be residual trading volume and someone willing to pay a rock-bottom price in the hope that the asset will return to its former glories, just as paragon fleetingly did today. Even for those coins that are artificially coaxed back into life, however, the movement merely reaffirms that they are on the way out and destined for an entry on Deadcoins.com. Paragon is already there. Do you think exchanges should be more proactive in delisting low-volume altcoins? Let us know in the comments section below. OP-ed disclaimer: This is an op-ed article. The opinions expressed in this article are the author’s own. Bitcoin.com does not endorse nor support views, opinions or conclusions drawn in this post. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the Op-ed article. The opinion editorial is for informational purposes only.Images courtesy of Shutterstock and Coinmarketcap.

Need to calculate your bitcoin holdings? Check our tools section. The post Pump and Dumps Are the Final Indignity for Dying Coins appeared first on Bitcoin News.

51% attack Bitcoin gold manipulation N-Featured Op-Ed P&D paragon PRG pump and dump SEC verge Yobit