After the Boss Calls Bitcoin a ‘Fraud’ — JP Morgan Buys the Dip

Just recently news.Bitcoin.com reported on JP Morgan executive Jamie Dimon calling bitcoin a “fraud” and claiming he would fire any employee from his firm who traded the digital currency for being “stupid.” Now it seems JP Morgan has been caught red-handed purchasing a bunch of XBT shares, otherwise known as exchange-traded-notes, that track the price of Bitcoin. Also read: Bitcoin Proponents Respond to JP Morgan Executive’s Statements

Just recently news.Bitcoin.com reported on JP Morgan executive Jamie Dimon calling bitcoin a “fraud” and claiming he would fire any employee from his firm who traded the digital currency for being “stupid.” Now it seems JP Morgan has been caught red-handed purchasing a bunch of XBT shares, otherwise known as exchange-traded-notes, that track the price of Bitcoin. Also read: Bitcoin Proponents Respond to JP Morgan Executive’s StatementsAfter a Few Harsh Statements from Executive Jamie Dimon, JP Morgan Ltd., and Morgan Stanley Purchase Bitcoin ETNs

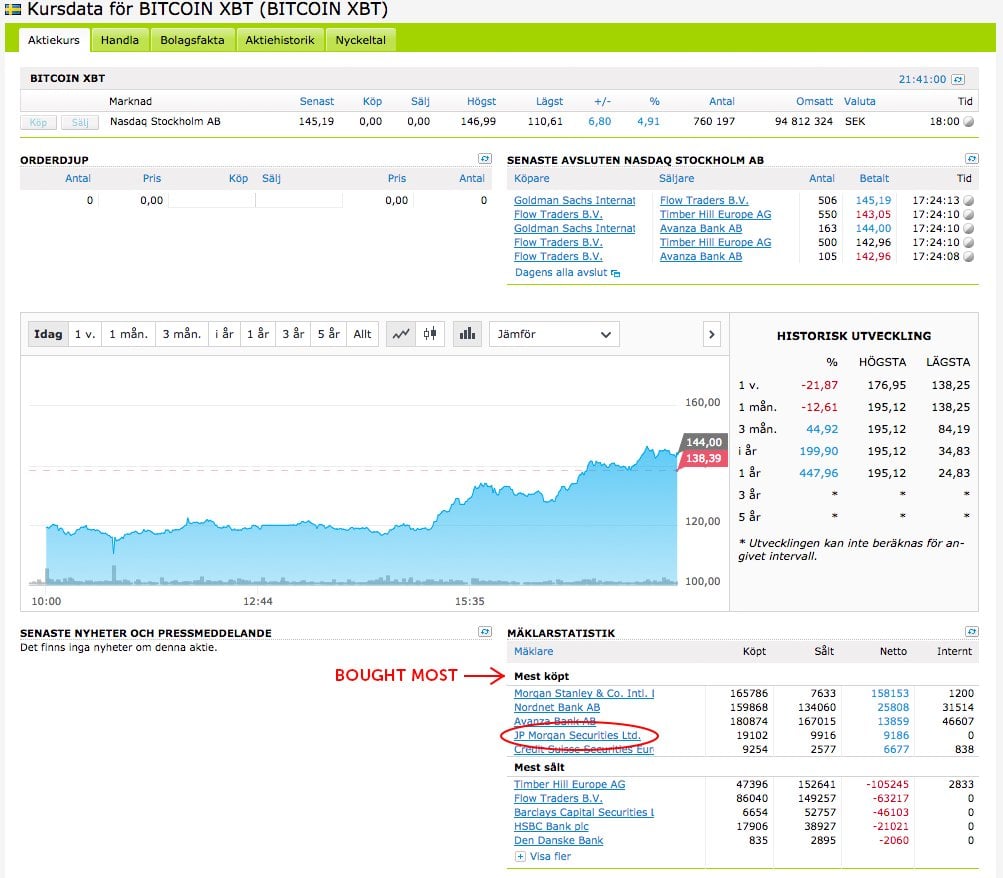

According to public records of Nordnet trading logs, the two associated firms JP Morgan Securities Ltd., and Morgan Stanley bought roughly 3M euro worth of XBT note shares. Interestingly after the recent regulatory crackdown in China, and the statements from JP Morgan’s senior executive Jamie Dimon talking trash about bitcoin, his firm bought the dip on September 15. In fact, out of all the companies on the list, like Goldman Sachs and Barclays, the JP Morgan team of buyers purchased the most XBT notes.

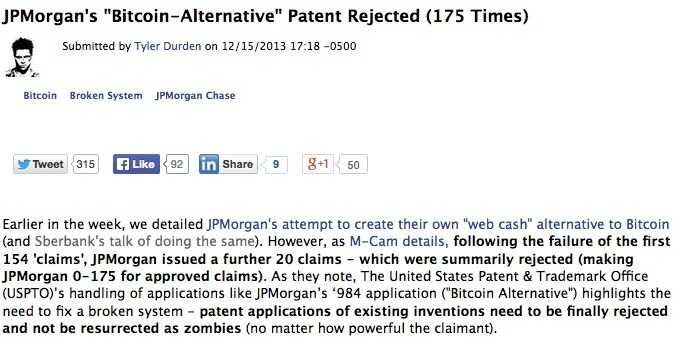

JP Morgan Applies for Blockchain Patent 175 Times

JP Morgan doesn’t just purchase bitcoin notes, but is also heavily involved with the ‘blockchain fever’ that has infected banks across the world. The financial firm has applied for a “bitcoin alternative” patent with the U.S. over 175 times in 2013. The company is also working on an ethereum-based blockchain alongside, according to people familiar with the matter, working with Zcash development as well. With the ethereum project called “Quorum,” JP Morgan has its own Github repo that explains how the permissioned blockchain does not need consensus mechanisms like Proof-of-Work (POW) or Proof-of-Stake (POS).

Former JP Morgan Executives Leave the Firm for Bitcoin and Blockchain Projects

Images via Pixabay, Bloomberg Markets, IamNomad, and Zerohedge.

Need to calculate your bitcoin holdings? Check our tools section. The post After the Boss Calls Bitcoin a ‘Fraud’ — JP Morgan Buys the Dip appeared first on Bitcoin News.

bitcoin tracker Blockchain blythe masters BTC Daniel Masters ETNs exchange traded notes Fraud Jamie Dimon JP Morgan N-Featured Patent XBT

2 Responses

Is Bitcoin vulnerable to quantum computing?

I don’t think soo.

Please read the following article to get more info about it:

https://www.forbes.com/sites/amycastor/2017/08/25/why-quantum-computings-threat-to-bitcoin-and-blockchain-is-a-long-way-off/